SIMONE DEL ROSARIO: HE’S ANTI-WOKE. ANTI-ESG.

VIVEK RAMASWAMY: I will tell you firsthand, they are hungry for this message.

SIMONE DEL ROSARIO: AND HE’S HOPING TO SHAKE UP THE CORPORATE WORLD.

VIVEK RAMASWAMY: i hope that a new voice–a new what i call a post ESG voice can actually drive behavior in the other direction.

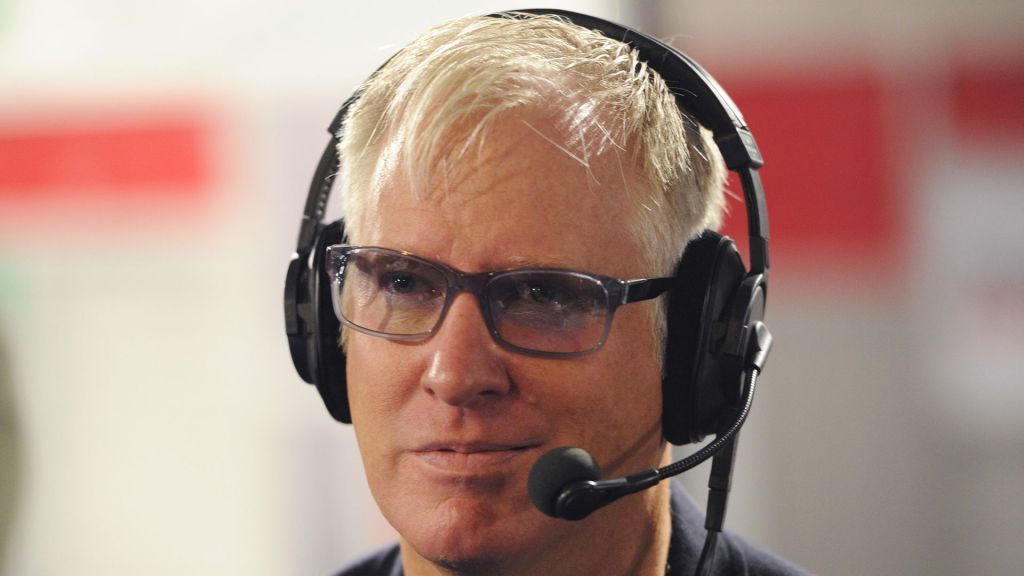

SIMONE DEL ROSARIO: PUTTING MONEY BEHIND HIS MISSION TO COUNTER SO-CALLED “WOKE CAPITALISM” – VIVEK RAMASWAMY IS JUST ONE NAME YOU NEED TO KNOW TODAY.

A HEDGE FUND MANAGER TURNED BIOSCIENCES CEO – RAMASWAMY STORMED ON THE SCENE IN 2015 – AT AGE 30.

VIVEK RAMASWAMY: RVTV101 is a unique drug that we actually think could help millions of patients with alzheimer’s disease.

SIMONE DEL ROSARIO: THE DRUG MAY HAVE FAILED, BUT THAT WAS JUST ONE CHAPTER FOR THE NOW 37 YEAR OLD.

THE TWO-TIME AUTHOR IS BACK WITH A NEW CRUSADE: STRIVE ASSET MANAGEMENT – A CONSERVATIVE COUNTER TO FUNDS LIKE BLACKROCK.

VIVEK RAMASWAMY: what strive is doing is delivering a new mandate, what i call the post ESG mandate, to the U.S. energy sector, to drill for more oil, to frack for more natural gas, to do whatever allows them to be the most successful over the long run without regard to political, social, cultural, or environmental agendas.

SIMONE DEL ROSARIO: BACKED BY BIG-TIME BILLIONAIRES PETER THIEL AND BILL ACKMAN – STRIVE HAS TWO FUNDS TO DATE.

ONE THAT INVESTS SOLELY IN U-S ENERGY COMPANIES, AND ONE THAT INVESTS BROADLY IN THE 500 LARGEST U-S PUBLICLY TRADED COMPANIES. AND RAMASWAMY’S USING THESE INVESTMENTS TO PERSUADE THE LIKES OF CHEVRON, APPLE AND DISNEY – TO IGNORE THE POLITICS AND ENVIRONMENTAL DEMANDS OF SOME OF ITS OTHER, LARGER SHAREHOLDERS.

VIVEK RAMASWAMY: i’m putting pressure on a lot of these politicized demands now what you hear in response from the blackrocks of the world is you hear that no no no no no this is just about long run value creation that argument ends up being a farce.

SIMONE DEL ROSARIO: OF COURSE THOSE MAKING THAT ARGUMENT ARE AT ODDS WITH RAMASWAMY, INSISTING ENVIRONMENTAL, SOCIAL AND GOVERNANCE DECISIONS WILL MAKE COMPANIES MORE PROFITABLE AND VIABLE IN THE LONG RUN. AND RAMASWAMY’S HAPPY TO BE THE “ANTI” VOICE OF IT ALL.

VIVEK RAMASWAMY: any company i hope chevron included is going to be better off from actually bringing these debates into the board room rather than unquestioningly accepting the claims of shareholders at one end of its spectrum .

SIMONE DEL ROSARIO: ACTIVIST INVESTOR VIVEK RAMASWAMY, JUST ONE NAME YOU NEED TO KNOW.