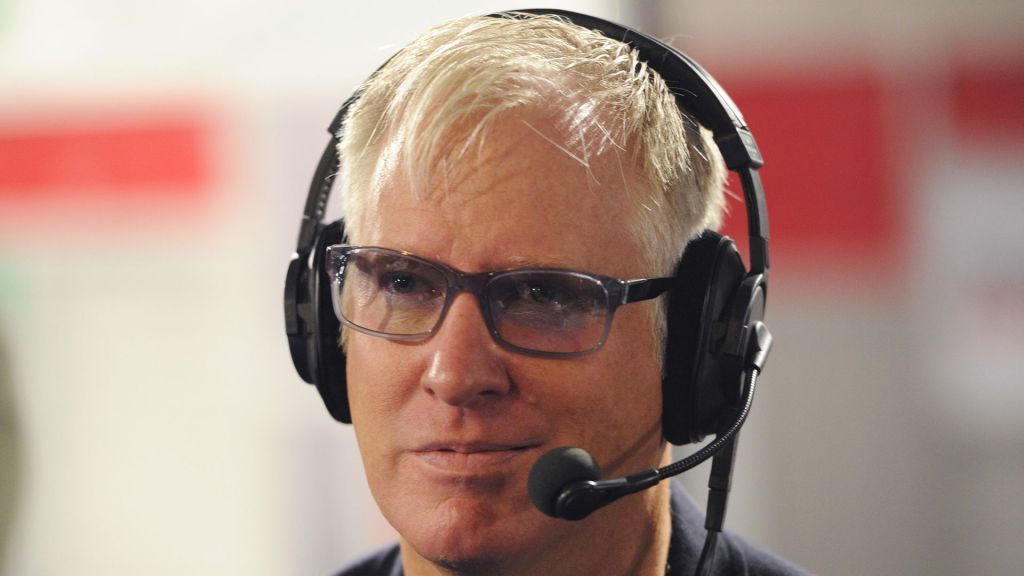

SIMONE DEL ROSARIO: inflation confronts us at every turn after a probable peak in July the eight and a half percent annual rise in prices is still near four decade highs. So how far will the Fed go to bring down inflation? Let’s bring in former Fed insider and CEO of quill intelligence. Danielle DiMartino Booth. Danielle, thank you for being with me today.

DANIELLE DIMARTINO BOOTH: Thank you for having me.

SIMONE DEL ROSARIO: With monthly inflation stabilizing in July, do you think that’s a sign that the steps the Fed is taking are working? Or was it a one off?

DANIELLE DIMARTINO BOOTH: I think that there are many signs that the Fed is achieving its goal of destroying demand. And if that’s the aim in order to make housing cool off, which we’re clearly seeing, then the Fed is achieving one of its goals of beginning to temper inflation. But there are so many other sources that suggest, whether it’s food or housing, housing is 40% of the CPI, that suggests that the Fed’s battle is not nearly begun, much less ended. This is no mission accomplished moment. The Fed has a lot more work to do, even though we are seeing signs that tightening monetary policy, that rising interest rates, are indeed slowing the economy, which we know is one of the Feds stated goals at this point.

SIMONE DEL ROSARIO: Where do you Fed rate hikes go from here?

DANIELLE DIMARTINO BOOTH: So I think I think investors are under estimating the Feds resolution there will continue tightening. The biggest contributor to inflation is housing. That’s a 40% input to your headline CPI. And we anticipate to see that number actually move up. As we head into the fall before peaking and rolling over. We call that the stickiest kind of inflation. And even though we’ve seen obviously prices at the gas pump come down, we still have food also at the highest level of food inflation at the highest level since 1979.

SIMONE DEL ROSARIO: Okay, so you kind of touched on this, but as far as market reaction goes, What do you think investors are seeing in this economy right now? And how they’re reacting to inflation numbers to other indicators we’re seeing? And are those investors right? Are they too hopeful at this point?

DANIELLE DIMARTINO BOOTH: I think investors are giving a whole new meaning to, to bad news being good. And that is if you see the Empire State manufacturing survey collapse to the lowest level in its history back to 2001. They’re like, that’s fantastic. The recession is even worse than we thought it was. If you see building starts or building permits, also collapse to levels that we last saw in the last housing bust, investors are like even better, this really is going to put the fed on hold and prevent the Federal Reserve from tightening. Yes, the Fed has pivoted in the past. And in the past, when the economy has slowed, the Fed has reacted by loosening policy. But all of those past episodes that we refer to for the past 40 years, inflation was less than 2%. Today, it’s more than four times that level.

SIMONE DEL ROSARIO: Something we haven’t spent a ton of time talking about is the Fed’s balance sheet, we know that they’re about to double the rate at which they’re shrinking the balance sheet at a time when we do have two quarters of negative GDP and some pretty miserable consumer confidence out there. That coupled with the aggressive rate hikes we’re seeing, do you think a soft landing is still in reach?

DANIELLE DIMARTINO BOOTH: No, I don’t. My favorite GDP model and that of s&p Global shows that the third quarter estimate right now is oh point 4%. So we’re within a hiccup away of the third quarter being the third consecutive negative print in a row, which would really leave little doubt in anybody’s mind about the possibility of a soft landing. So I think But I don’t think that there are very, very many people on the street who continue to talk about the possibility of a soft landing. Absent those perhaps in the White House.

SIMONE DEL ROSARIO: How aggressive do you think the Fed will be with these rate hikes? I know we’re awaiting a decision now in September.

DANIELLE DIMARTINO BOOTH: So I think that a lot of investors are contemplating and anticipating that the Fed is going to pause after the September meeting. And in fact, I have publicly advocated for the Fed to pause specifically for the November meeting, because it six days before Election Day, and to call for a blackout that that continues through Election Day, and then resume rate hikes at the December meeting. But to your point that you brought up earlier, there’s this issue of shrinking the balance sheet quantitative tightening. I anticipate that even though the Fed may pause in its rate hike campaign, that it may keep going in the background, so to speak, those are words that chair Powell himself is used, that the Fed may continue with the quantitative tightening in the background, which depletes and pulls liquidity from the financial system and still acts as a as a form of tightening in the financial system.

SIMONE DEL ROSARIO: Do you have any guesses on where you think inflation could get to by year’s end?

DANIELLE DIMARTINO BOOTH: You know, there are so many conflicting, disinflationary forces on the discretionary side we’re seeing used car prices really begin to come down hard, we expected to see that. But there are so many conflicting discretionary inflationary prints that are going down versus your housing and your food inflation, which seems to be stubbornly high. It’s very hard to say, but I would not be surprised if we had something in the realm of six to 7%. By the time we get to the new year, it’s entirely feasible, again, giving housings big weight in the CPI 40%.

SIMONE DEL ROSARIO: I’m sure you’ve heard the word and I want to get your take on it, or a session or vibe, the session right now.

DANIELLE DIMARTINO BOOTH: I think that what we’re looking at right now is as plain vanilla a recession as we possibly could have. I understand that a lot of people think that the Fed is engineering what we’re seeing right now, and that things really are all good and well. But if you look at what’s happening in China, and you look at what’s happening in Germany, the third largest exporting nation in the world, and the rest of Europe and the slowing that we’re seeing in Asia, you’d have to be blind to suggest that the United States was going to to avoid a recession, given the simple pressure coming from outside of the rest of the world in addition to the slowing that we’ve seen here domestically.

SIMONE DEL ROSARIO: Great points quill intelligence CEO Danielle DiMartino booth, thank you so much for being with me today.