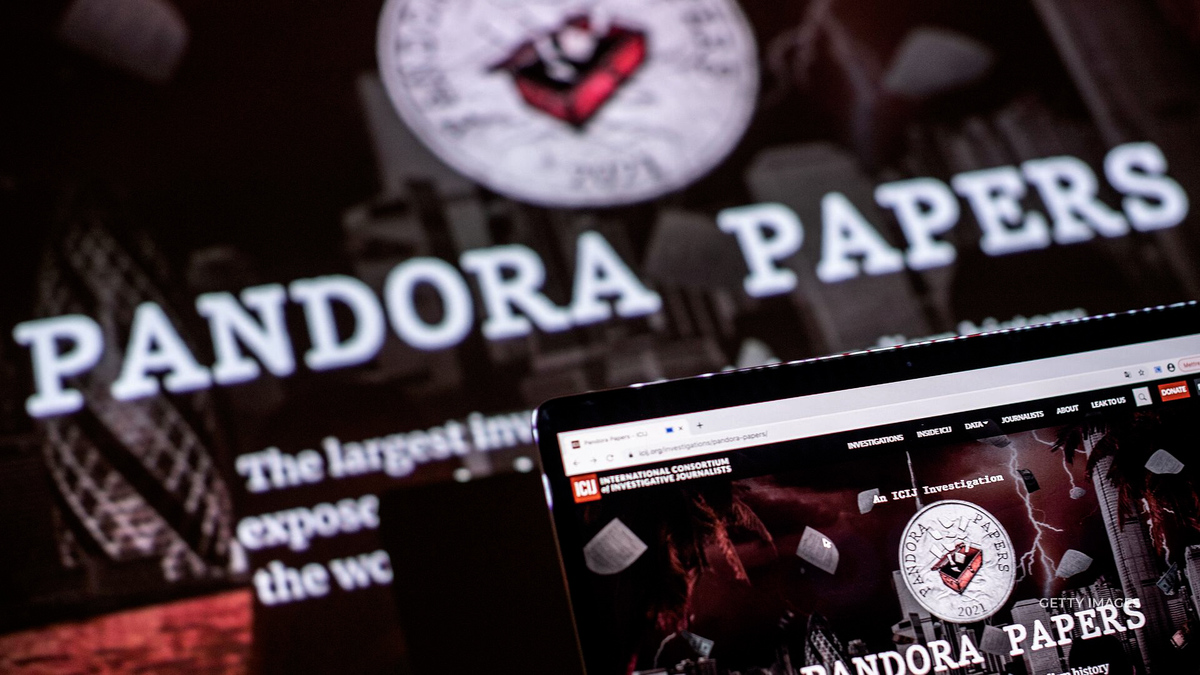

SIMONE DEL ROSARIO: FINANCIAL SECRETS OF THE RICH AND POWERFUL ARE EXPOSED.

THE LARGEST INVESTIGATION IN JOURNALISM HISTORY UNEARTHS OFFSHORE MONEY MOVES MADE IN THE SHADOWS AROUND THE GLOBE.

WORLD LEADERS, POLITICIANS AND BILLIONAIRES ARE ALL IMPLICATED IN WHAT’S BEING CALLED THE PANDORA PAPERS.

THE INTERNATIONAL CONSORTIUM OF INVESTIGATIVE JOURNALISTS ANALYZED NEARLY 12 MILLION CONFIDENTIAL FILES, LEAKED FROM 14 OFFSHORE BANKS AND TAX PROFESSIONALS.

THE BANKS SERVE WEALTHY PEOPLE AND CORPORATIONS SEEKING SHELL COMPANIES AND WAYS TO ESCAPE TAXES.

MANY ARE LEGAL BUT SOME ARE NOT.

600 JOURNALISTS FROM 150 NEWS OUTLETS SPENT TWO YEARS DIGGING THROUGH THE DATA.

THE HIDDEN RICHES OF 35 CURRENT AND FORMER WORLD LEADERS AND MORE THAN 300 POLITICIANS FROM 91 COUNTRIES ARE IN THE PAPERS.

THE INVESTIGATIVE JOURNALISTS SAY MANY OF THE POWER PLAYERS WHO COULD HELP BRING AN END TO OFFSHORE TAX HAVENS INSTEAD BENEFIT FROM IT.

LIKE JORDAN’S KING ABDULLAH THE SECOND, ACCUSED OF USING OFFSHORE SHELL COMPANIES TO SPEND MORE THAN 100 MILLION DOLLARS ON LUXURY HOMES IN THE U.S. AND U.K. WHILE HIS OWN PEOPLE STRUGGLE.

A DAY AFTER THE REVELATION, HE SAID, “THERE IS NOTHING I HAVE TO HIDE FROM ANYONE.” AND SAID THE LEAK WAS JUST AN EFFORT TO TARGET JORDAN AND SOW DISCORD.

AND CZECH REPUBLIC’S PRIME MINISTER ANDREJ BABIŠ IS ALSO DENYING WRONGDOING AFTER SHOWING UP IN THE PANDORA PAPERS.

HE ROSE TO POWER PROMISING TO CRACK DOWN ON TAX EVASION AND CORRUPTION, BUT THE REPORT SHOWS IN 2009 HE USED SHELL COMPANIES IN TAX HAVENS TO BUY A 22 MILLION DOLLAR CHATEAU IN FRANCE AND NEVER DISCLOSED IT.

AND HE’S UP FOR REELECTION THIS WEEK.

TAX HAVENS CAN BE IN UNEXPECTED PLACES. MOVE OVER, CAYMAN ISLANDS. SOUTH DAKOTA IS ONE OF 15 U.S. STATES AND D.C. WOOING BIG MONEY.

A TRAIL OF TENS OF MILLIONS OF DOLLARS MOVED FROM OFFSHORE ACCOUNTS IN THE CARIBBEAN TO THE MOUNT RUSHMORE STATE.

IT’S NOW A MAJOR DESTINATION FOR FOREIGN ASSETS, HOME TO 81 TRUSTS.

EXPERTS SAY FRIENDLY FINANCIAL SECRECY LAWS HAVE ELEVATED SOUTH DAKOTA FROM A STATE TO AN INTERNATIONAL TAX HAVEN.

IT’S NOT NECESSARILY ILLEGAL TO MOVE MONEY TO THESE TAX-FRIENDLY HAVENS.

THE DEFENSE OF MANY IMPLICATED IN THE PANDORA PAPERS IS JUST THAT: THEY DIDN’T BREAK ANY LAWS.

BUT THE PAPERS DO BRING A SHADY FINANCIAL SYSTEM OUT OF THE SHADOWS.

WHEN THE SAME GROUP OF JOURNALISTS RELEASED THE “PANAMA PAPERS” FIVE YEARS AGO, THE REVELATIONS LED TO DISGRACED EXITS FROM LEADERS IN ICELAND AND PAKISTAN; THE STORIES HELPED COUNTRIES RECOUP MORE THAN 1.36 BILLION DOLLARS IN UNPAID TAXES, FINES AND PENALTIES; AND GOVERNMENTS CHANGED LAWS TO CRACK DOWN ON TAX EVASION.

DO YOU THINK THE PANDORA PAPERS WILL LEAD TO SERIOUS CONSEQUENCES?

LET ME KNOW IN THE COMMENTS.

FROM NEW YORK – IT’S JUST BUSINESS.