SIMONE DEL ROSARIO: LEADING FINANCIAL EXPERTS ARE STARTING TO SAY THE “R” WORD A LOT MORE OFTEN.

WE’RE TALKING ABOUT RECESSION SOMETIME IN THE NEXT TWO YEARS – WHERE THE COUNTRY SEES NEGATIVE ECONOMIC GROWTH FOR AT LEAST TWO CONSECUTIVE QUARTERS.

GOLDMAN SACHS SENIOR CHAIRMAN LLOYD BLANKFEIN: It’s definitely a risk. If I were running a big company I would be very prepared for it, if I was a consumer I’d be prepared for it, but it’s not baked in the cake.

SIMONE DEL ROSARIO: GOLDMAN SACHS IS STILL SAYING THE CHANCE OF A RECESSION IS AROUND 35%.

BUT IT IS PENCILING IN SLOWER ECONOMIC GROWTH THIS YEAR AND NEXT, NOW DOWNGRADING THIS YEAR FROM 2.6 TO 2.4%, AND SLASHING NEXT YEAR’S GROWTH FROM 2.2% TO 1.6.

FINANCIAL INSTITUTIONS ARE NOT JUST SOURING ON ECONOMIC ACTIVITY – BUT MARKETS AS WELL.

INVESTORS ARE NOT CONVINCED THIS IS THE BOTTOM AFTER THE S&P 500 DIPPED AROUND 17% FROM JANUARY’S HIGH, ITS SECOND WORST START TO THE YEAR IN HISTORY.

MORGAN STANLEY IS BEARISH – THINKING THE DIP COULD DOUBLE – AND THAT “THE RISK OF A RECESSION HAS GONE UP MATERIALLY.”

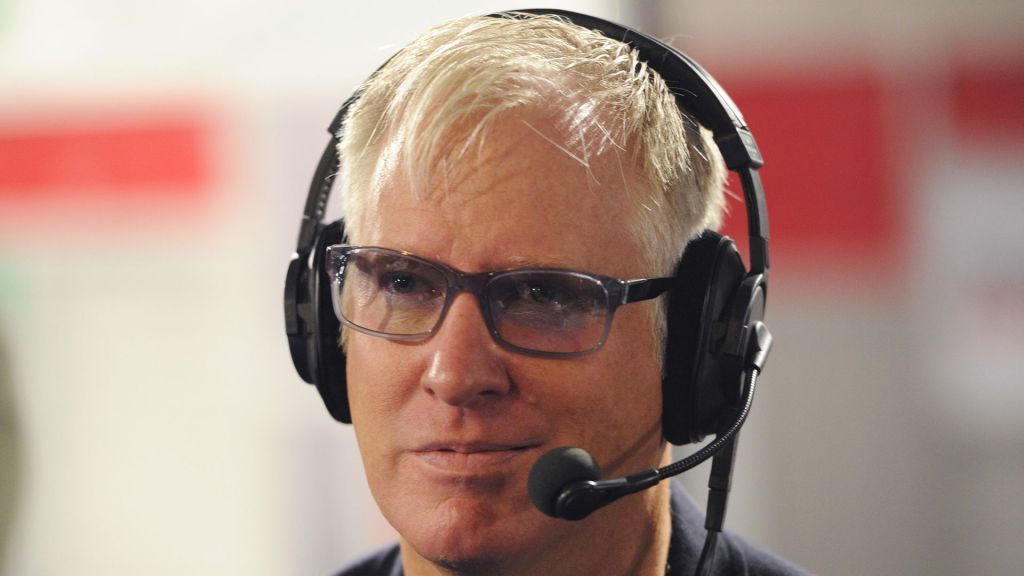

IN NEW YORK FOR JUST BUSINESS I’M SIMONE DEL ROSARIO.