The ownership group of the Los Angeles Angels has announced its intention to sell the team in what could be the most expensive transaction in American sports history. Forbes’ most recent valuation of the Angles checked in at $2.2 billion, and the publication predicts its ultimate sale price could exceed even that number. With an expected price tag in the $3 billion range, the LA-based franchise could rival the sale of the Denver Broncos, which topped the list of priciest U.S. sports franchise sales this year at $4.65 billion.

The potential Angels sale marks the latest big payday for outgoing franchise owners, with six of the most expensive American sports franchise sales happening in the last five years. With figures coming in the billions, it’s no surprise only the wealthiest can place a bid. A recent report by money manger UBS and consultancy PwC found that billionaires own nearly 80% of the world’s top 140 sports brands.

The motivation for the ultra-wealthy to get in on the game comes from a U.S. tax code provision that allows for someone who buys a business to deduct almost the entire sale price against their income in years to follow. The savings that franchise owners can reap from utilizing this loophole can mean millions in additional income.

Investigative journalism outlet ProPublica illustrated the enormous savings from these tax deductions by breaking down the finances of three individuals who attended a March 2019 NBA game featuring the Los Angeles Lakers and Los Angeles Clippers.

It discovered that a concession worker at the contest who made just under $45,000 dollars a year had paid 14.1 percent in federal income taxes from the previous year. Meanwhile LeBron James, the Lakers four-time MVP superstar, who had earned a total of $121 million in 2018, paid a tax rate of 35.9 percent.

While the tax cut taken from James’ paycheck was unsurprisingly larger than that of the concession worker, the 18-time All-Star was far from the wealthiest man at the game that night.

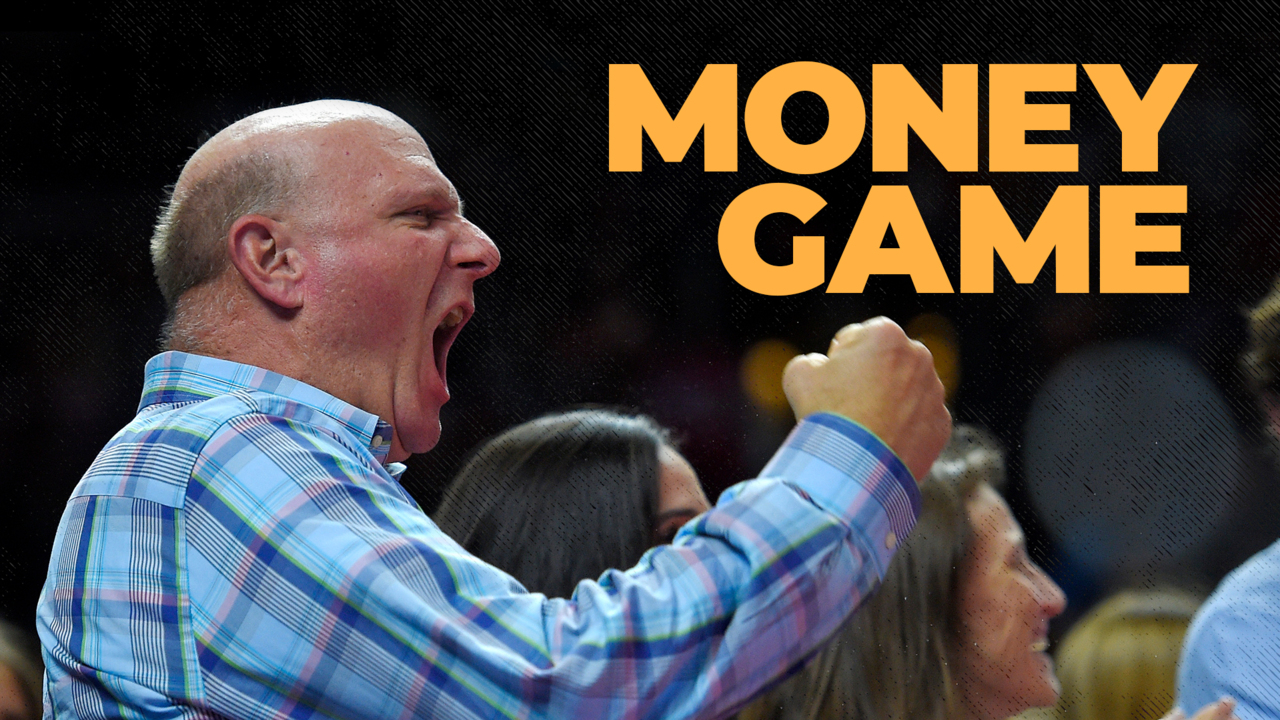

Clippers owner Steve Ballmer, after making over $650 million the year before, paid just a 12 percent tax rate, much lower than that of James, and even less than the rate paid by the concessions worker.

In Ballmer’s case, the $2 billion he spent on purchasing the Clippers in 2014 continued to be deductible from his taxable income, and he’s not the only billionaire in sports to take advantage of such financial maneuvers. Los Angeles Rams and Colorado Avalanche owner Stan Kroenke, Orlando Magic owner Daniel DeVos, and Los Angeles Kings owner Philip Anschutz all paid less than 15% in income taxes despite all having a net worth of over five billion dollars.