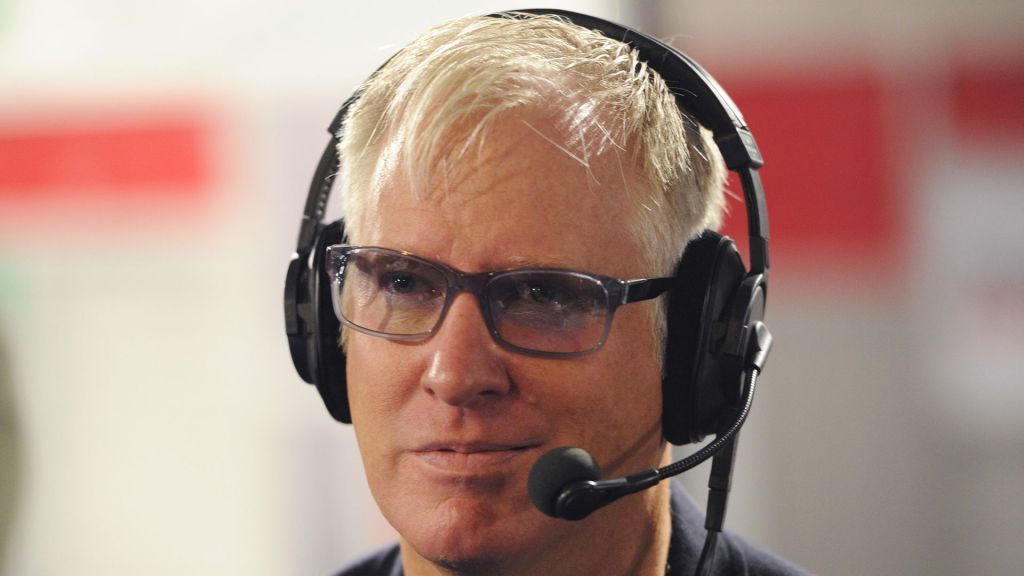

SIMONE DEL ROSARIO: This morning, we were all stunned with the January jobs report. It showed the US economy added more than half a million jobs its strongest showing since July, while the unemployment rate dropped to 3.4%. That’s the lowest rate since May of 1969. It’s surprisingly good, but also has us scratching our heads a little bit as we hear of widespread layoffs in the tech sector, slowing growth and higher interest rates. So here to help us make sense of it all is Sinem Buber, lead economist at ZipRecruiter. Sinem, first of all, what were your thoughts as the numbers came out this morning? And what do you think it tells us about the jobs economy?

SINEM BUBER: Well, it’s telling us as you said, the jobs number was really stunning. More than half a million jobs when we were expecting it to grow around 180 to 200,000 new jobs, more than twice the pace we expected and reverse the trend that we had seen at the end of 2022. We had seen the jobs numbers slowing down since the summer of 2022, when we started seeing the first impact of the high interest rates. So today’s number took everyone by surprise. But it’s really good news because it tells us that the labor market is stronger than we thought and the Federal Reserve still has strong some room to increase the interest rates further if that is what it takes to keep the prices under control.

SIMONE DEL ROSARIO: Yeah, so the Fed just hiked its interest rate by 25 basis points this week. It was the first normal size rate hikes since March. Does this mean the Fed should go heavier on the pedal? Should they have hiked it by 50 basis points instead?

SINEM BUBER: Well, I don’t think they will increase the pace at this point. Because one of the great things that the Federal Reserve has done so far is managing the expectations about the interest rate hikes really well. So I think we will follow another 25 basis point in March and probably one more in May as well. But today’s number tells us that if the inflation is not going to slow down at the pace that they want it to then they are ready to go more rate hikes in the second half of 2023. That is definitely not something the market wanted to see.

SIMONE DEL ROSARIO: We keep hearing about predictions of an impending recession. Do you think that this January jobs report rebuffs that?

SINEM BUBER: Yes, absolutely. It defied all the expectations of a potential recession. Today’s number, and the overall revised picture of 2022 tells us that the labor market is really strong, and it’s ready to absorb more interest rate hikes, if that’s what it takes to take, you know, put the inflation number down. So we’re one step closer to a soft landing than a potential recession. What we heard from the Federal Reserve initially at the beginning of 2022, and started when they started increasing the rate hikes was it comes with a little bit pain, especially on the labor market side, they told us that we might expect the unemployment rate to go up to around 4.6%. But that’s not what we’re seeing. So far. The unemployment rate is as low as it has been since 1969. So there is a chance for a soft landing for us to see disinflationary path coming with no cost at the labor market side.

SIMONE DEL ROSARIO: Can that be achieved? Can we see inflation go down with unemployment this low or does it complicate trying to bring inflation down if the labor market stays this strong?

SINEM BUBER: Well, I think one of the complications we are seeing on the labor market side is not the unemployment rate going down, but also labor supply not going up. So labor force participation rate has ticked up a little bit in January, but partially reflecting the, you know, annual revisions we have seen on the census data, right now to 62.4%. And that’s what is concerning right now, it’s much lower than what we had before the pandemic, that simply that number tells us the share of population in the workforce. And if you’re not going to see more people coming back into the workforce in 2023, this is what will complicate things for the Federal Reserve. That means the labor shortages will remain strong in 2023. That’s what is going to drive wages up further.

SIMONE DEL ROSARIO: Sinem, I want to ask you about something and bear with me through these statistics. But we have been seeing a lot of employment contradictions happening after the fact. Last month, the Philadelphia Fed said they thought that the BLS overestimated job growth by more than a million jobs in the second quarter of 2022. And then we had the BLS his own business employment dynamics report that came out showing a net loss of 287,000 jobs in the private sector in q2. But now BLS revisions have come out saying q2 was revised down by just 59,000 jobs, kind of rejecting those two views of the employment situation. What’s with these conflicting pictures of the labor market.

SINEM BUBER: So there are three different survey reports coming from the BLS telling us about the employment picture, the one that we need to take is their current establishment survey. This is the number we had seen this morning. Now the number that you just cited 287,000 jobs loss in the second quarter of 2022, is coming from the business employment dynamics report, that report coverage and estimation technique is completely different than the current establishment survey it’s looking at the state unemployment insurance, data and administrative data. It’s not a survey data, the main purpose of that report is to tell us about the business cycles. So how are stipulated birth and the death rate of establishments? So it’s telling us how the business cycle is doing? A fair comparison would be to compare that number with the GDP number, which is another proxy for the business cycles. And it’s aligned with the contraction that we had seen in the second quarter of 2022. So compared to BED employment estimate, with the, you know, CES employment assessment we have seen this morning wouldn’t be apples to apples, it wouldn’t be a fair comparison, that we’re talking about employment gains, especially at the industry level, we take the current establishment survey more seriously than the other reports. So overall, when we look at it, the picture is that too, in 2022, the labor market was stronger than we thought initially last month, with the first print of the numbers, it was four and a half million jobs at it. Now with the revise is 4.8 million jobs added in the economy. So the economy is the labor market is still strong.

SIMONE DEL ROSARIO: What are you predicting for the job economy as we go into 2023. And throughout?

SINEM BUBER: Well, we will see the impact of the high interest rates slowly, it generally comes with a lag up to 10 to 12 months of lag. So what we started in March, increasing rates will start showing the impacts in a couple of months. So by the end of the first part of 2023, we’re gonna see those numbers pulling off much more significantly than the trends that we had seen so far. So in 2023, also, the slowdown will be more spread more broad base right now we’re just seeing the impacts on the interest rate and inflation sensitive industries. This is going to be much more, you know, broader, more, you know, spread out to the other industries. And we’re likely to see the wage growth to slow down even further. And that’s great news on the inflation fight side. Because the wage inflation is a big concern for the Federal Reserve is a big threat when it comes to keeping the prices under control.

SIMONE DEL ROSARIO: Sinem Buber, lead economist at ZipRecruiter, really appreciate you breaking down all that for us today. Thank you.

SINEM BUBER: Thank you so much.