Former President Donald Trump’s holding company, DJT Holdings LLC, reported a combined 313 million dollars in losses from 2015 to 2020.

The losses range from a high of more than 64 million and low of 34 million.

But the returns also show the company had well over 600 million dollars in assets for every year but 2020 when it closed out with 577 million.

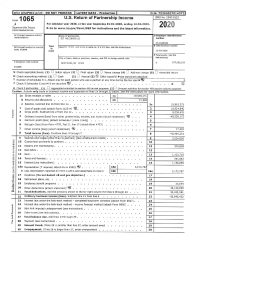

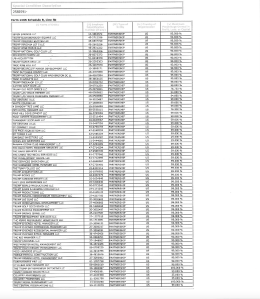

The 1065 Schedule B form shows this holding company owns more than 80 LLCs which cover properties like the Trump National Golf Club Washington DC, management companies for his hotels in Miami and Chicago, a production company and restaurants.

This information was revealed with a massive release of his tax returns by the House Ways and Means Committee that cover his personal and business earnings from 2015 to 2020.

Trump said in a statement that the tax returns quote: “show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.”

To review all the documents and see our story on his personal tax returns, visit StraightArrowNews.com