SIMONE DEL ROSARIO: IT’S ONE OF WALL STREET’S HOTTEST FADS. FROM A-ROD TO TRUMP, IT SEEMS EVERYONE IS GETTING IN ON IT.

BUT WHAT EXACTLY IS A SPAC? LET’S GET INTO IT IN TODAY’S WORD ON THE STREET.

SPAC STANDS FOR SPECIAL PURPOSE ACQUISITION COMPANY. SOMETIMES CALLED A BLANK-CHECK COMPANY, IT’S A SHELL CORPORATION SET UP BY INVESTORS WITH THE SOLE PURPOSE OF RAISING MONEY THROUGH AN INITIAL PUBLIC OFFERING TO EVENTUALLY ACQUIRE A PRIVATE COMPANY.

STILL FOLLOWING? BASICALLY, IT’S A FAST-TRACKED WAY TO MAKE A PRIVATE COMPANY PUBLIC WITHOUT GOING THROUGH THE TRADITIONAL IPO PROCESS.

HERE’S HOW IT WORKS. FIRST A MANAGEMENT GROUP, MADE UP OF SPONSORS, DECIDE TO FORM A SPAC. THEY RAISE MONEY THROUGH AN IPO, SELLING UNITS TO INVESTORS.

KEEP IN MIND, INVESTORS DON’T KNOW WHAT THEY’RE GETTING WHEN THEY BUY IN. THE SPAC AT THIS POINT HAS NOT TARGETED A COMPANY, IT DOESN’T HAVE A PRODUCT, A TRACK RECORD OR ASSETS BEYOND THE MONEY RAISED IN THE IPO. SO THEY’RE REALLY PUTTING THEIR MONEY BEHIND THE MANAGEMENT TEAM – BETTING ON THEM TO FIND SOMETHING GREAT. A BLANK CHECK, IF YOU WILL.

MORNINGSTAR EDITORIAL MANAGER RUTH SALDANHA SAYS RECOGNIZABLE SPONSORS ARE A BIG DRAW, FROM CELEBRITIES TO VENTURE CAPITALISTS.

RUTH SALDANHA: THERE HAVE BEEN INVESTORS WHO HAVE DONE SUCCESSFUL SPACS IN THE PAST, AND THAT, THEREFORE, THE INVESTOR THINKS THAT THIS IS A GOOD TIME FOR US TO GET INTO THIS AT THE GROUND FLOOR AND MAYBE MAKE A LOT OF MONEY. AND SO THAT’S WHY THEY’RE PERHAPS FLOCKING TO IT.

SIMONE DEL ROSARIO: OK SO ALL THE MONEY THAT’S RAISED FROM INVESTORS GOES INTO AN INTEREST-EARNING TRUST. NOW SPONSORS HAVE UP TO TWO YEARS TO ACQUIRE A PRIVATE COMPANY THEY THINK HAS TREMENDOUS UPSIDE TO TAKE IT PUBLIC.

IF THEY DON’T FIND A COMPANY IN THAT TIME, THE SPAC DISSOLVES AND INVESTORS BASICALLY GET THEIR MONEY BACK. IF THEY DO FIND A COMPANY, THE SPAC AND THE PRIVATE COMPANY MERGE INTO A PUBLICLY TRADED COMPANY. AT THIS POINT, INITIAL INVESTORS CAN DECIDE IF THEY LIKE THE MERGER AND WANT TO STAY INVESTED OR PULL OUT THEIR MONEY.

SOMETIMES IT BOOMS AND MAKES INITIAL INVESTORS RICH, LIKE WHEN THE SPAC DIGITAL WORLD ACQUISITION CORP ANNOUNCED ITS MERGER WITH FORMER PRESIDENT DONALD TRUMP’S MEDIA COMPANY. AND SOMETIMES IT BUSTS, LIKE WHEN SOUTHEAST ASIA’S RIDE-HAILING GIANT GRAB LOST MORE THAN 20 PERCENT OF ITS VALUE ITS FIRST DAY OF TRADING.

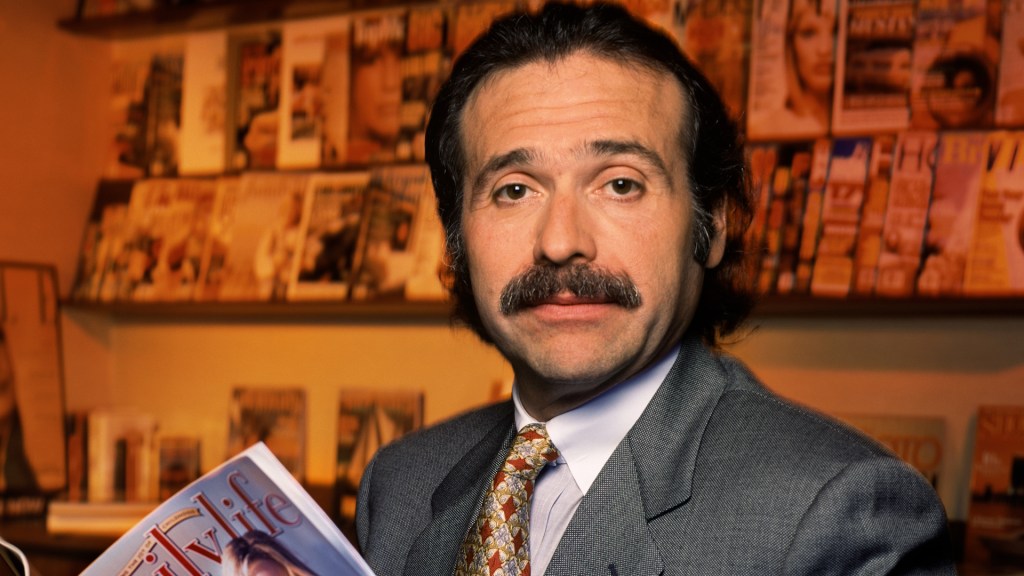

PROFESSOR JAY RITTER IS KNOWN AS “MR. IPO” FOR HIS EXTENSIVE WORK IN THE FIELD.

JAY RITTER: IT’S NOT A ONE SIZE FITS ALL, WHERE EVERY COMPANY DECIDES THAT MERGING WITH A SPAC IS THE RIGHT WAY TO GO. BUT OBVIOUSLY, HUNDREDS OF COMPANIES ARE DECIDING TO DO IT. SO IT’S GOT SOME ATTRACTIONS.

SIMONE DEL ROSARIO: THE NUMBER OF SPAC IPOS HAS EXPLODED THE PAST TWO YEARS. ONE DRAW FOR PRIVATE COMPANIES – IS THAT IT’S A MUCH SHORTER RUNWAY TO PUBLIC.

RUTH SALDANHA: FOR TRADITIONAL IPO, IT COULD TAKE ANYWHERE FROM SIX MONTHS TO WELL OVER A YEAR FOR A COMPANY TO GO FROM PRIVATE TO PUBLIC, BUT IN THIS CASE OF SPACS THAT HAS BEEN CRUNCHED DOWN TO JUST A FEW MONTHS. 1:18

SIMONE DEL ROSARIO: BUT PERHAPS THE DIFFERENCE THAT REQUIRES THE MOST SCRUTINY COMES FROM REGULATION. WHILE A TRADITIONAL IPO PUTS ALL THE FINANCIALS ON THE TABLE – THE SPAC PROCESS IS MORE PRIVATE. SO INVESTOR RISKS MIGHT NOT BE SPELLED OUT. THAT’S ONE REASON THE S-E-C IS NOW TAKING A CLOSER LOOK AT SPACS.

JAY RITTER: THE SEC DOESN’T TRY AND DECIDE FOR INVESTORS: IS THIS A GOOD DEAL OR A BAD DEAL. THEY JUST WANT TO MAKE SURE THAT INVESTORS HAVE ENOUGH INFORMATION TO BE ABLE TO EVALUATE A DEAL. 10:08

SIMONE DEL ROSARIO: NOW THAT YOU KNOW THE DEAL WITH SPACS, WHAT OTHER TERM DO YOU WANT TO HEAR ABOUT IN OUR ‘WORD ON THE STREET’? DROP IT IN THE COMMENTS.