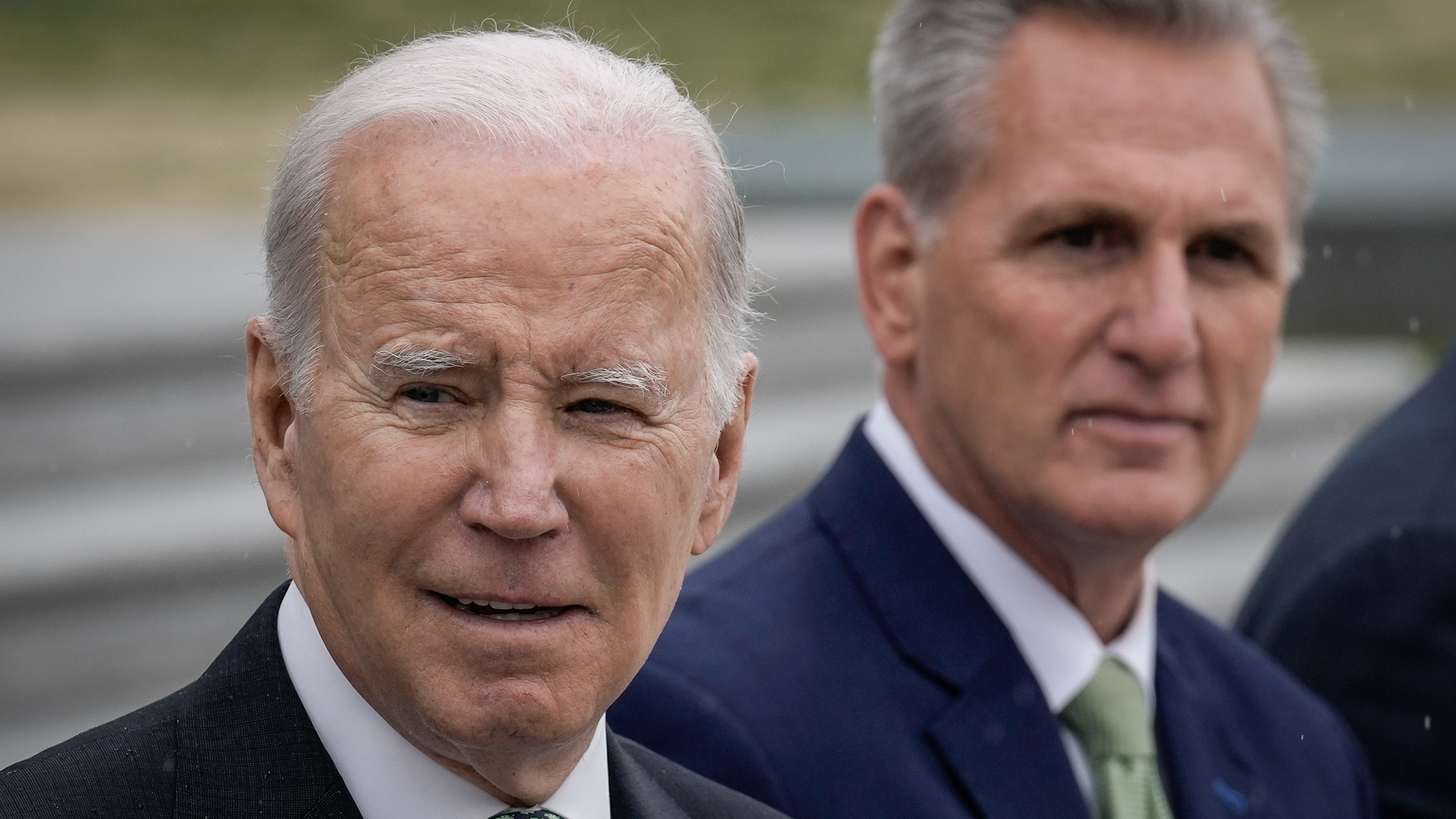

SIMONE DEL ROSARIO: In the words of House Speaker, Kevin McCarthy, we’ve got a ticking time bomb on our hands. He was talking about the national debt. And right now the Treasury warns, we’re as few as four weeks away from breaking the debt ceiling. On Tuesday, May 9, we’ve got a high stakes meeting between the White House and congressional leaders to talk about raising that ceiling before financial calamity ensues. But so far, both sides have not budged. House Republicans have come forward with the limit, save and grow Act, which trades raising the ceiling for spending cuts. While Democrats are insisting on a clean debt hike. I want to bring in economist Kevin Hassett. Kevin is a former senior adviser to the Trump administration, former economic adviser to several leading Republican presidential campaigns. He’s also a distinguished visiting fellow at the Hoover Institution and a visiting fellow at the Lindsey group. Kevin, I know this just a fraction of your resume. But we’ve got some questions. So thank you for joining me today.

KEVIN HASSETT: Great, it’s great to be here.

SIMONE DEL ROSARIO: Listen, I spent the morning listening to the Senate Budget Committee hearing, I heard Moody’s chief economist Mark Zandi testified that at this point, Congress just asked to just suspend the debt ceiling, he says there’s not enough time to hammer out negotiations. Do you think we’re running out of track on this? Or are you seeing and hearing movement in Washington to actually come to some sort of bipartisan agreement?

KEVIN HASSETT: Well, the history of it is that we always come to an agreement in the end, and that there’s a game of chicken right up to the last minute. And there even have been times when the debt limit has been lifted, you know, sort of a month at a time while negotiations go on. And so my expectation is that they’ll come to a deal eventually, it might not even happen, that they come to a long term deal anytime soon. But if they don’t, then probably they’ll kick the can down the road, a month or two. The fact is that most debt limit increases in the past have included the kind of concessions that speaker McCarthy is asking for. And President Biden doesn’t necessarily want to make those concessions, certainly in a bargaining game, he doesn’t want to make them up front. But in the end, you know, presidents have budged in the situation that he’s in. Indeed, if you really just go back and look at President Obama’s term, he had a negotiation with Speaker Boehner very similar to this. And they ended up cutting spending $1 for every increase of the debt limit by $1. And those negotiations, by the way, were called the Biden negotiations, because Vice President Biden at the time led them

SIMONE DEL ROSARIO: Ranking member Senator Chuck Grassley said today that the House bill is just a starting point and opening bid, he essentially was saying, don’t take it, and it’s details at face value. Do you agree with that?

KEVIN HASSETT: You know, I think that it is a metric of what Speaker McCarthy would like to do. But it’s a first offer at a bargaining table as well. And so you know, you don’t go into, you know, like knowing in your, in your head that you’re willing to pay $300,000 for a house, you know, but you go and you offer 250 To start, right. And then if they’re good at it, they drive you as close to 300 as they can, and then you walk up, you know if they go higher than that. So I think negotiating a lot of times people will start with asks that are far removed from what they’re willing to accept. You know, that’s probably true for Speaker McCarthy as well. But you know, it’s a bargaining game, and they’re playing it right now. And and both sides, you know, are appearing to be like completely entrenched, but both sides are probably going to budge in the end.

SIMONE DEL ROSARIO: Well, here are some of the details of the limit, save grow act, the CBO says it’s going to reduce federal budget deficits by 4.8 trillion over the next decade. But then Moody’s will bring him back says it will also cut nearly 800,000 More jobs in 2024. Alone, compared to a clean debt hike. What are your thoughts on that?

KEVIN HASSETT: Well, you have to understand, first of all, the the reduction in the deficit over 10 years is a very significant number. To put it in perspective, the national debt has gone up by about $6 trillion, since President Biden took office and so you’re almost undoing the harm that he’s caused since he’s been there. And so it’s a real reduction in government spending and the deficit. Now, the Moody’s economy.com model of the economy is a very what we call Keynesian model. It’s a model that thinks that government spending has a big negative effect on GDP if it goes down. And the Moody’s guys, I’m friends with Mark Zandi, you know that their their views are honestly held. But if you look at the empirical track record of that model, it’s not very good. And I think that they tend to overstate the negative effects of reducing government spending, and understate the positive effects of restoring fiscal sanity. Imagine if all of a sudden you know, people all around the world believed that the US was going to have smaller deficits in the future. Well, that would lower interest rates in the US because you’d be you’d be less worried about debt being inflated away, and that would be a positive and that kind of positive is just not in their model.

SIMONE DEL ROSARIO: Well, look, we talked about this $4.8 trillion deficit cut but the White House is also Come to the table with cuts of their own. The White House says its budget would cut federal budget deficits by 3 trillion over the next state decade, of course, that comes with higher taxes is raising taxes a non starter, if it comes with spending cuts, you think

KEVIN HASSETT: it’s a negotiation. And you know, the Democrats always want to raise everybody’s taxes, and then they’ll sort of claim they’re not going to raise the taxes of people with incomes below 400,000 or something like that. But if you actually look at it, they always lift taxes on everybody. And, you know, I think that that’s what they want to do. They’re going to the bargaining table, they’ll probably demand that there’ll be some tax hike in the final bill. I wonder if speaker McCarthy would budge on that. Because there’s so many Republicans that know that tax hikes, you know, hurt ordinary citizens, blue collar workers the most. And so they probably will not want to concede on that issue. My guess is that in the end, the the deal is probably spending reduction and increase in the debt limit. And that’s kind of what the last deal was to where it was Obama and Boehner, and that the tax hikes will be saved for another day, because basically, McCarthy won’t get the Republican votes that the President would need for them to pass such an agreement through the house.

SIMONE DEL ROSARIO: Okay, so let me play devil’s advocate on this one. Republicans saying no tax increases, that’s an non negotiable. Wouldn’t that be the same as Democrats saying no spending cuts?

KEVIN HASSETT: Oh, yeah, you’re exactly right. The it’s, it’s a complicated bargaining game. But but the one thing that I can say that you’re exactly right, that the logic of the positions is symmetric, at and so and they’re playing a game of chicken, because if they go past the deadline, then you know, the US will default on its debt in the sense that it will not make interest payments that it supposed to make on money that it borrowed. So you know, right now, they’re playing a game of chicken. And they’re both taking strong stances in order to drive like the eventual bargain in their direction. And the only thing that we, as observers have really is history to go on. And if you look at history, then what tends to happen is that you get spending cuts and a debt limit increase, but not tax hikes. And so in the past, I think that, you know, the simpler connection to the to which McCarthy is seeking is what the process has produced, just just as it did when Joe Biden ran the negotiations for President Obama.

SIMONE DEL ROSARIO: But here’s also a history tells us the closer that we get to this limit, the longer we let the game of chicken play out, the more the economy is going to be harmed. Even if we don’t end up defaulting on our debt. We’ve seen this in the past, why not suspend the debt ceiling and really hammer out a budget that deals with the national debt down the road, and we have a little bit more time.

KEVIN HASSETT: You know, that’s, that’s what you and I would do. But But I think we know each other, and trust each other, these people know each other and don’t trust each other. And I think for good reason. And so, you know, the world is filled with sort of political promises that have been made and then broken. And so my guess is that what’s going to happen is that in the end fit that McCarthy, you know, might be willing to kick it down the road a little bit, like lift it for a month at a time or something. That’s something that has happened in negotiations of the past. But I think that that’s about as far as he’s gonna go to allowing the debt limit to go up without some kind of spending cuts.

SIMONE DEL ROSARIO: Do you foresee any moderate Republicans crossing the aisle and saying, you know, what, just pass it even if it’s kicking the can down the road just a little bit? Or right now? Do you feel like McCarthy has that coalition pretty tight?

KEVIN HASSETT: I think he has a tight coalition. Don’t forget the McCarthy bill passed the House with just one vote to spare. And, you know, there’s maybe some tactical advantage to that, because McCarthy can say to the president, look, I only had one vote to spare, I can’t change a thing. So so maybe if he, you know, grabbed his whip, he would have gotten more votes than that. But the fact is that he doesn’t have a lot of wiggle room. And I think that that’s quite relevant for the negotiations.

SIMONE DEL ROSARIO: Regardless of where people stand on these negotiations, nearly all sides, reasonable sides agree that we are on an unsustainable path when it comes to the national debt. And the blame, as we know is on both parties for reaching 31 point 4 trillion. Where is the tipping point to you? How many years? Do we have to get it under some level of control before we’re past the point of no return?

KEVIN HASSETT: You know, that’s that’s the right question. And the answer is a little unsatisfying, but it’s like very visible in a vast academic literature. And the answer is that it could happen at any moment. Or it could be a long time off. That what happens when a government defaults is that you know, it borrowed a whole bunch of money saved from the Chinese a year ago, and now it has to give the Chinese their money back and to do that they have to borrow a bunch of money from either the Chinese again or somebody else. us, and they have an auction, you know, they show up Monday morning, and they have an auction to try to borrow money from somebody sell some bonds to them. So they can pay back the guys, they borrow money from last year. And then nobody shows up. And that’s the history of all the debt crises we’ve seen all around the world, especially in South America. And it can happen overnight. And so if people really lost confidence in the US ability to govern itself, then you could have an auction on Monday, that fails. And and it’s not crazy to think that that could happen to us, because we’ve increased debt so much. And for sure, you’re right, that that’s happened under both party when both parties are in the White House that the debt has gone up. That we’ve increased it so much, that for example, our debt relative to our national income to our GDP is about 40%, higher than it is in Argentina, a country that everybody knows is potentially in trouble. And so we are at a situation where you know, measures like speaker, Speaker McCarthy’s are necessary to restore the US to a sustainable path. And we’re pretty darn close. The final thing is with interest rates higher, the cost of having that debt is much bigger than it was when interest rates were low, of course. And right now it’s looking like for this year, the interest payments on that debt will be bigger than defense spending our total defense budget. So that’s a metric of how imperiled you know our current design of our government is by the high debt and the high interest rates that we’re looking at.

SIMONE DEL ROSARIO: I know that the White House doesn’t necessarily want to show this card and listening to Fed Chair Jerome Powell, he certainly doesn’t want to either. But if the White House goes nuclear on this, if they don’t reach a deal at the table, and the White House tries to act on its own, what would be the impact in Washington and for the country.

KEVIN HASSETT: I think that there’s sort of two types of of nuclear weapon here. There’s the White House, violating the Constitution, and ignoring the debt limit, and then coming up with some excuse that allows them to do that for a while. And the Treasury Secretary continues to cut checks to people. And even though they don’t really have the authority to do that, the way to think about that type of nuclear option is that you could think of the US Treasury, which basically does what the president tells them, they’ve got a checking account at the Federal Reserve. And if the Federal Reserve says they’ve got enough money to pay for stuff, then they can pay for stuff. So that’s nuclear option number one. And I think that, you know, basically, no, White House has been willing to try something like that in the past, because they’re pretty sure I think by the time he got to the Supreme Court, that it would be overturned. The second nuclear option is to just basically let us hit the debt limit, and then let financial markets melt down because they’re worried that we’re going to default on our debt. And, you know, I think it’s possible that the bite administration might try to, you know, make it look like we’ve done that for a few days in order to put pressure on Republicans as possible. There was one other time in history when we sort of hit the last stop and went past it. But at that point, there was a dispute between Congress and the White House about spending and the Democrats controlled, you know, basically the Senate, the house or the White House, but there were people in Congress that wanted to spend more than the White House wanted to it. So. So it has happened, that we’ve gone sort of past the deadline, and it might happen again. But again, I think that if you look at the negotiation that President Biden had, when he managed the negotiations for President Obama, then you’ve got a nice outline for what’s a pretty reasonable compromise. And finally, last thought on this is that, you know, President Biden is running for reelection. And one of the things that he said about, you know, the argument for him in the White House, is that he’s a guy who can sort of do sensible things and work well with the other side. And so I think that, you know, retreating if he were to retreat to the deal that President Obama got that that would be very popular with voters, you know, swing voters and moderate voters and both parties, so I can sort of see a political reason why he might do that as well.

SIMONE DEL ROSARIO: Well, we will be watching closely what happens on Tuesday when all of these leaders get together to see if they can save the country before that financial calamity comes as early as June. Thank you so much. Economist Kevin Hassett really appreciate your time.

KEVIN HASSETT: Thank you.