SIMONE DEL ROSARIO: DAYS AFTER TWO U-S BANKS FAILED, A SWISS BANK IS NOW IN CRISIS.

CREDIT SUISSE SHARES SANK AS MUCH AS 30% WEDNESDAY, HITTING A NEW RECORD LOW AND DRAGGING DOWN GLOBAL MARKETS ALREADY JITTERY FROM BANK INSTABILITY.

THE FALLOUT IS NOT RELATED TO THE DEMISE OF SILICON VALLEY AND SIGNATURE BANKS, BUT THE TIMING LIKELY CAUSED A MORE VISCERAL REACTION TO THE SWISS BANK’S TROUBLES.

ON TUESDAY, CREDIT SUISSE RELEASED ITS ANNUAL REPORT, REVEALING “MATERIAL WEAKNESS” THAT COULD LEAD TO MISSTATEMENTS IN ITS FINANCIAL REPORTING.

THEN ON WEDNESDAY, THE BANK’S LARGEST SHAREHOLDER, SAUDI NATIONAL BANK, SAID IT WON’T BUY MORE SHARES TO HELP CREDIT SUISSE, FUELING THE ROUT.

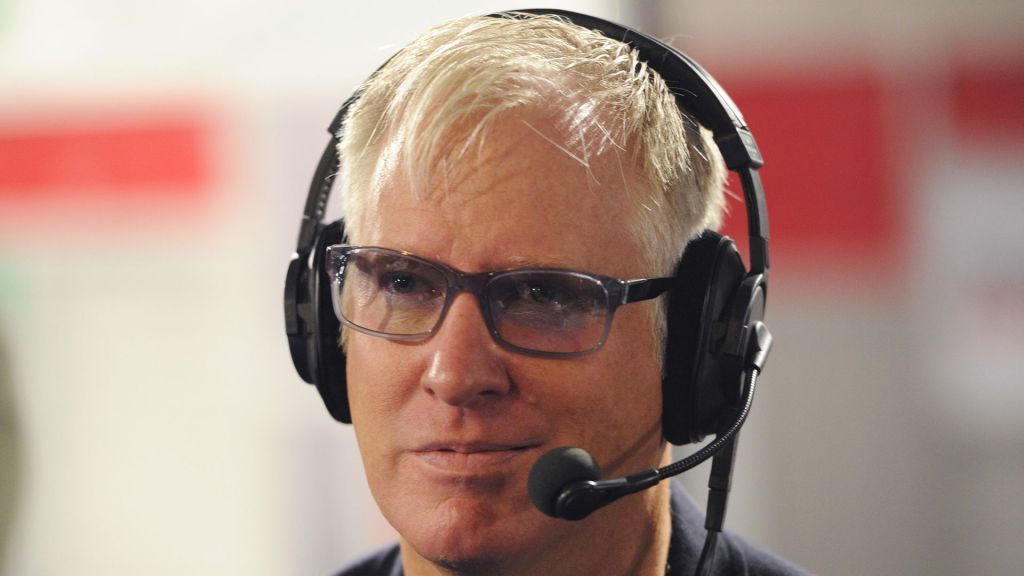

Ammar Al Khudairy, Saudi National Bank Chairman: We now own 9.8% of the bank we go above 10% all kinds of new rules kick in whether it be by our regulator or european regulator or the swiss regulator and we’re not inclined to get into a new regulatory regime.

SIMONE DEL ROSARIO: ECONOMISTS ARGUE THE SURVIVAL OF CREDIT SUISSE IS A MUCH BIGGER DEAL FOR THE GLOBAL ECONOMY THAN THE U-S REGIONAL BANKS THAT HAVE STRUGGLED IN THE PAST WEEK.

THE INVESTMENT BANK HAS MUCH BROADER EXPOSURE. IT’S SWITZERLAND’S SECOND LARGEST BANK AND DOES SUBSTANTIAL BUSINESS IN THE U-S.

BLOOMBERG REPORTS THE FEDERAL RESERVE IS ACTIVELY REVIEWING THE U-S FINANCIAL SECTOR’S EXPOSURE TO CREDIT SUISSE AMID THE TURMOIL.

I’M SIMONE DEL ROSARIO IN NEW YORK IT’S JUST BUSINESS.