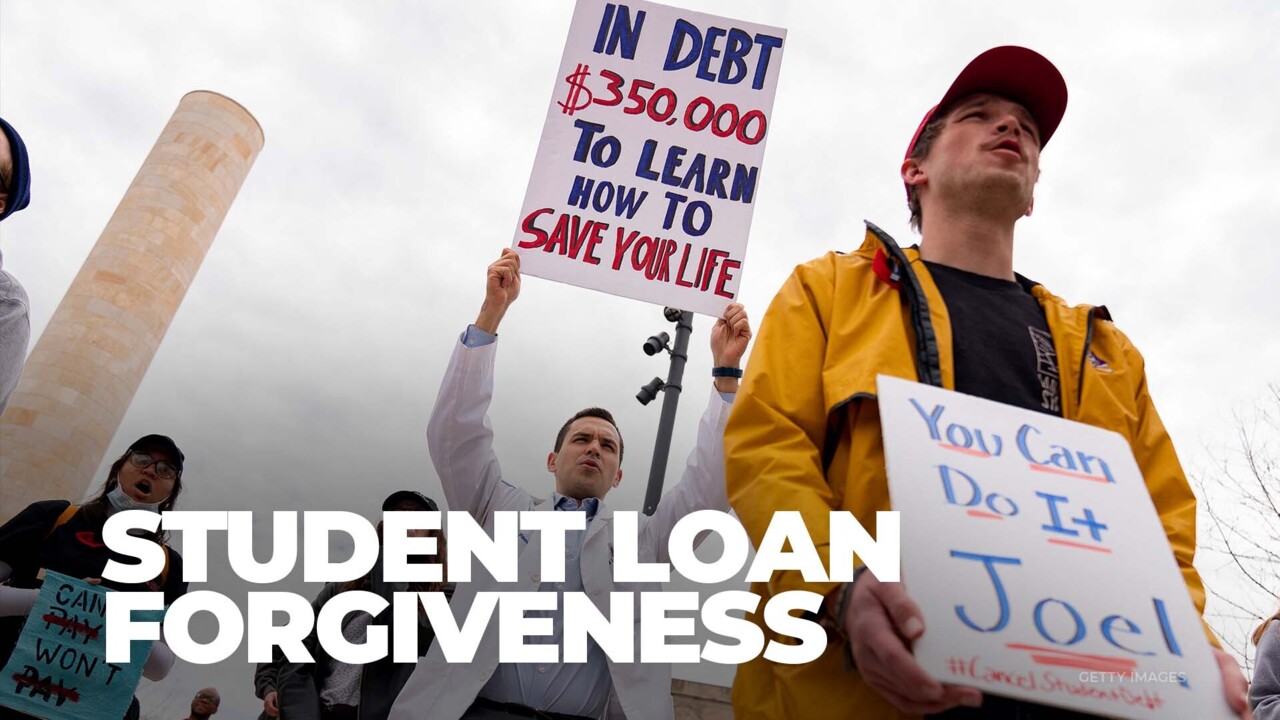

The moratorium on Student loan payments and interest is set to expire August 31st. Meaning, President Biden has a big announcement to make within the next two weeks as to whether he will end or extend the freeze. Political experts say with the midterm elections right around the corner, he will almost certainly keep the policy in place.

Jim Moran says: The Department of Education has not notified the loan services to prepare for any repayment schedule. So I think those with student loans, who of course, are in the 10s of millions, about 40 million, they can relax at least for the next few months.

Moran expects the President to keep the pause going until at least the end of January 2023, and he wouldn’t be surprised if Biden provides loan forgiveness.

Jim Moran says: I think there may even be some expansion of the Public Service Loan Forgiveness. Certainly to nonprofits that are for the purpose of enhancing society and the economy, you’ll probably get an expansion of the public service definition for loan forgiveness.

Once the midterms are over, there are still political variables to take into account. For instance, if the Democrats achieve their goal of forgiving $50,000 per borrower, Moran says there could be some negative consequences.

Jim Moran says: “Well, I do think the Biden administration needs to be careful about this. It because a lot of the working class doesn’t go to college. And they resent people who do, being able to have their tax money paid, essentially, to relieve their indebtedness. And then there are other families who have paid off their debts, and are going to be resentful of people who were able to avoid paying off those debts.”

Straight from DC, I’m Ray Bogan.