Commentary

-

Our commentary partners will help you reach your own conclusions on complex topics.

Hi, everyone, Peter Zion here coming to you from snowy Colorado. And I thought, after promising this for a few weeks, it was time to finally deliver. And it’s time to talk about electronic vehicles and why they are not going to be an appreciable part of our transport future for at least the next decade, probably closer to three. First and foremost, from a carbon point of view, EVS really don’t stack up very well. They are among the most energy consumptive projects that humans have engaged in to this point. Even if you use Tesla data, which is

biased and incomplete, they only deal with the battery assembly, and they assume 100% clean power for recharging your vehicle and 100% clean power for making the vehicle, they still say that on a standard grid that was 100%. Green, it’s still gonna take you over a year to break into some sort of neutrality compared to the carbon footprint of a conventional vehicle. Now, if you include the fact that almost all of the processing for all of the materials and all the mid assembly is done in China on coal power, and if you include the fact that things like the frame, which doesn’t go into their data are made out of a silicone, aluminum alloy, which is incredibly energy intensive, you’re really talking upwards of five and maybe as many as 10 years. And if you’re talking about a more conventional grid, like what we have in the United States, you have to increase it from there. So the numbers at least for now, just aren’t there. From a green point of view, there’s also the cost issue, you can’t get a lot of power, at least over sustained periods from an electric vehicle that you can get from a more conventional system. So right now, we technically do have the innovations and the technologies necessary to go Eevee for our light vehicles, and our light trucks, passenger cars, small pickups, that sort of thing. But we don’t have anything for the more powerful vehicles such as semis or airplanes or ships that actually make up over half of ton miles in the world. And even in those lighter categories, it’s a bit of a question mark. So think about not just the environmental issue, but the economic costs. So the opening model for the electrified F 150, the baseline model is 90 grand. So there’s a cost issue here, not just for the United States. But for the wider world. Most of these technologies just aren’t ready today. But what the really big issue comes down to is whether we can do it at all, from a physical point of view, like forget the cost, forget that these things are for the most part carbon bombs, look at what it takes to make these things. If you want to make it a conventional vehicle, obviously, the energy that is required comes from the fuel. But if you want to make an electric vehicle, you have to put in a much more sophisticated system that has a lot more material inputs, an order of magnitude, more material inputs, the aluminum, the silicone, the graphite, and so on. And we need so much more of that, if we’re going to make this happen need at least double the amount of copper and zinc, we need at least four times the amount of chromium and molybdenum, or however you pronounce it. And we need at least 10 times the graphite and the lithium, the world has never been able to increase the volume of something that it needs, whether it’s vegetable or animal or mineral by a factor of two in a 10 year period at any time in world history in any technological age. But we’re going to increase the amount of lithium that we kick out by a factor of 10 in eight years. I don’t think so. And it’s worse than it sounds because we’re losing a lot of the material production, a lot of the processing capacity. Russia is a top three producer of things on this list like zinc, and copper, and nickel. And then China is in a top three position for the processing for all of them. And typically number one for all of them. Well, we’re going to lose the Russian stuff because of sanctions in the Ukraine war. Even if sanctions do no damage to this industry, the Russians have proven time and time again, that they can’t maintain their own infrastructure without foreign investment and workers and they’re gone. And the Chinese system is dependent upon an economic model that is in its dying days, because globalization is over. They don’t have the demographic structure to make it happen in the first place. And the capital that would be necessary to make all of this work, even theoretically is also gone. Because that’s wrapped up in the retirement of the boomers as they liquidate all of their holdings and move into retirement, they’re not going to be able to afford the sort of risk that it takes to invest in cobalt production in Congo. They’re going to be going into municipal bonds, that doesn’t generate a lot of chromium. And if we start having to make economic and environmental decisions based on material constraints, then it’s just a lot more cost effective and carbon effective to pour money into wind turbines outside of Oklahoma City or solar panels outside of Phoenix than it does to build carbon bombs for our cities. Keep in mind that they have been carbon bombs to this point. Most Tesla’s that are on the road right now are not a first car or a second car they’re a third or fourth car their status symbols

conspicuous consumption at the highest level, which means that we really do need to talk about Tesla, just a little bit, three problems there. First of call, of course, the Elon factor, he has decided to showcase some of his personal politics, which are, let’s just call it a little erratic. And they tend towards the right, they tend towards the Trumpian. And the conspiratorial, right. But most of the people who have been buying Tesla’s to this point are armchair environmentalists who think that they’re better than everyone. And so they’re not interested in something that supports that general point of view. And so he’s basically alienated his primary consumer base. The second problem

is that Tesla is priced as an not a manufacturing company, but as an information technology company, like, say, Google or Facebook. And that’s a very different model. When you develop something in the information technology space, you can then sell it over and over and over and over, because the marginal cost of producing a next unit is nearly zero. But when you’re doing automotive manufacturer, you have to produce each and every vehicle independently and sell them independently. The first one is nearly infinitely scalable. The second one is linear, in an infinitely scalable environment, of course, the capital that flows ins to develop the model and develop the workforce and develop the skill sets and the patents. It comes from everywhere. And that’s why you see massive valuations in that space. But when you’re only selling one vehicle at a time, you can only maintain those valuations, so long as you are the only producer. And that is not the case for Tesla anymore. Yes, Tesla was the world’s largest producer for a while. But now every major automotive company in the world has an Eevee line. And in many cases, these are vehicles with more towing capacity, more weight, capacity and better range than Tesla has. So Tesla still has this panache as a luxury brand. But again, he’s offended the people who bought it for luxury reasons. Which brings us to the third problem, we’re facing a massive capital crunch. And that’s not something that’s simply going to affect the financing for vehicles are the mining of materials, but the capital that is available to keep Tesla’s stock above board at all, we have seen Tesla dropped by about 70% in calendar year 2022, as some of these factors have kind of come out indirectly.

For Tesla to be ranked to be priced like a normal automotive company normal automotive companies that in many cases now have superior Evie models and a better income stream and more experience making vehicles

Tesla Nazis to drop by 90%, not 90% total 90% of where it began this calendar year that would bring it even with Ford and Chevy in the rest. And that’s before you consider that Elon has systematically offended most of his existing customers. So this is not a stock tip or a recommendation. This is just a saying that we’re reverting to the mean and a lot of things and Tesla most certainly is not justified to be at the mean. Okay, that’s it for me. Until next time. Bye

-

Global warming won’t impact Russian-Chinese shipping

The seas above Russia’s northern coastline are too frozen for shipping, but some have wondered whether global warming might change that in the decades to come. If those seas were to become navigable for commercial shipping, new direct routes between Russia and China could theoretically open up. Straight Arrow News contributor Peter Zeihan throws more…

-

Can other nations replicate success of US shale revolution?

The “shale revolution” has provided the United States with a bountiful domestic supply of oil. But extracting oil from shale is a highly technical process, and it is also dependent on specific geological formations. Straight Arrow News contributor Peter Zeihan tackles the question of whether or not other nations might be able to replicate the…

-

Peace between Israel and Iran, at least for now

A series of recent airstrikes between Israel and Iran inflamed fears of a wider regional war erupting in the Middle East. That concern now seems to have paid off, after third-party countries around the world successfully intervened and talked down military hardliners in both Israel and Iran in order to avoid such an outcome. Israel’s…

-

Global internet in a precarious state, but that could be a positive

Over 500 underwater cables span over 870,000 miles worldwide, serving as the foundation of the modern global internet. Despite their critical role in facilitating communication, these cables often go unnoticed, even as the amount of data transmitted through them has surged. So what happens if the cables fail? Straight Arrow News contributor Peter Zeihan contends…

-

Water wars are an unlikely future

Foreign policy writers have long warned of the possibility that clean drinking water might become “the next oil” — that is, that major wars might be fought around the globe over access to potable water. With expanding populations and finite water supplies, these critics argue that humans will inevitably fight each other to secure drinking…

Latest Stories

-

DVIDS

DVIDS

Aid package to Ukraine ‘not aimed at achieving victory’

-

AP Images

AP Images

Poll: Majority of Americans back mass deportation of undocumented immigrants

-

Getty Images

Getty Images

Trump lawyers admit some actions alleged in indictment are private, not official

-

Getty Images

Getty Images

EPA coal plant rule cuts emissions 90%, removes 17M homes worth of power

-

AP Images

AP Images

As 2020 election lawsuits grow, Gateway Pundit files for Chapter 11 bankruptcy

Popular Opinions

-

In addition to the facts, we believe it’s vital to hear perspectives from all sides of the political spectrum.

Latest Opinions

In addition to the facts, we believe it’s vital to hear perspectives from all sides of the political spectrum. We hope these different voices will help you reach your own conclusions.

The opinions published in this section are solely those of the contributors and do not reflect the views of Straight Arrow News.

Latest Commentary

We know it is important to hear from a diverse range of observers on the complex topics we face and believe our commentary partners will help you reach your own conclusions.

The commentaries published in this section are solely those of the contributors and do not reflect the views of Straight Arrow News.

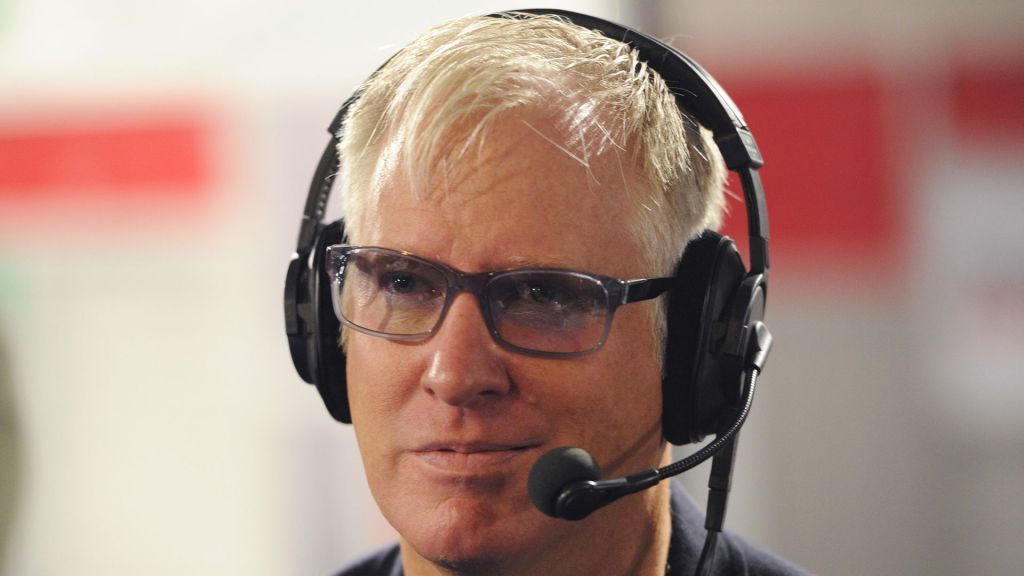

Peter Zeihan

Geopolitical StrategistCan other nations replicate success of US shale revolution?

Peace between Israel and Iran, at least for now

Global internet in a precarious state, but that could be a positive

Dr. Frank Luntz

Pollster and Political Analyst‘Take the job seriously’: Why Americans are fed up with Congress

‘If we can shrink it, it will stop growing’: Americans talk debt, deficit

‘I don’t think they care’: Undecided voters explain their reasons

Pete Ricketts

U.S. Senator for Nebraska